Financial Investment

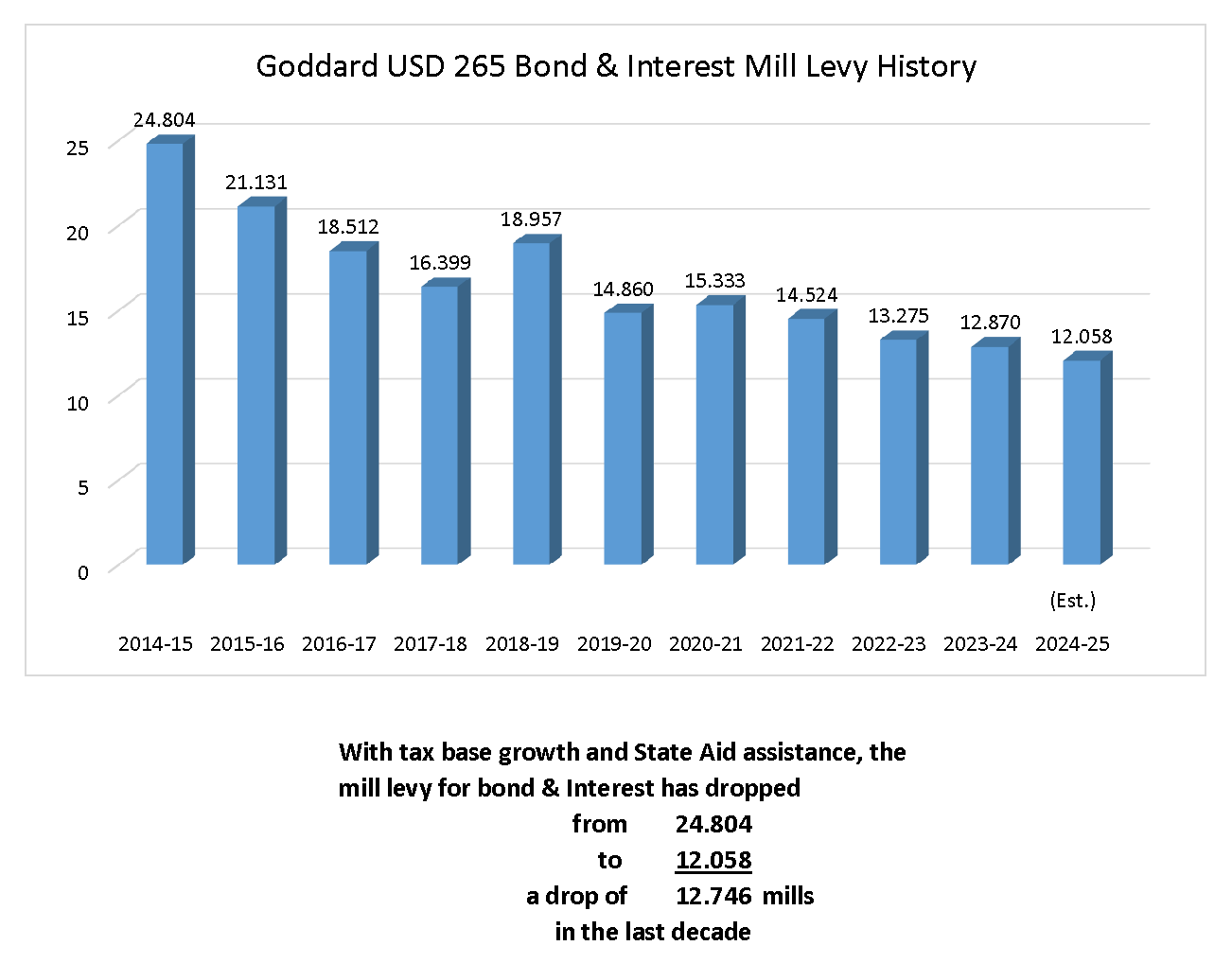

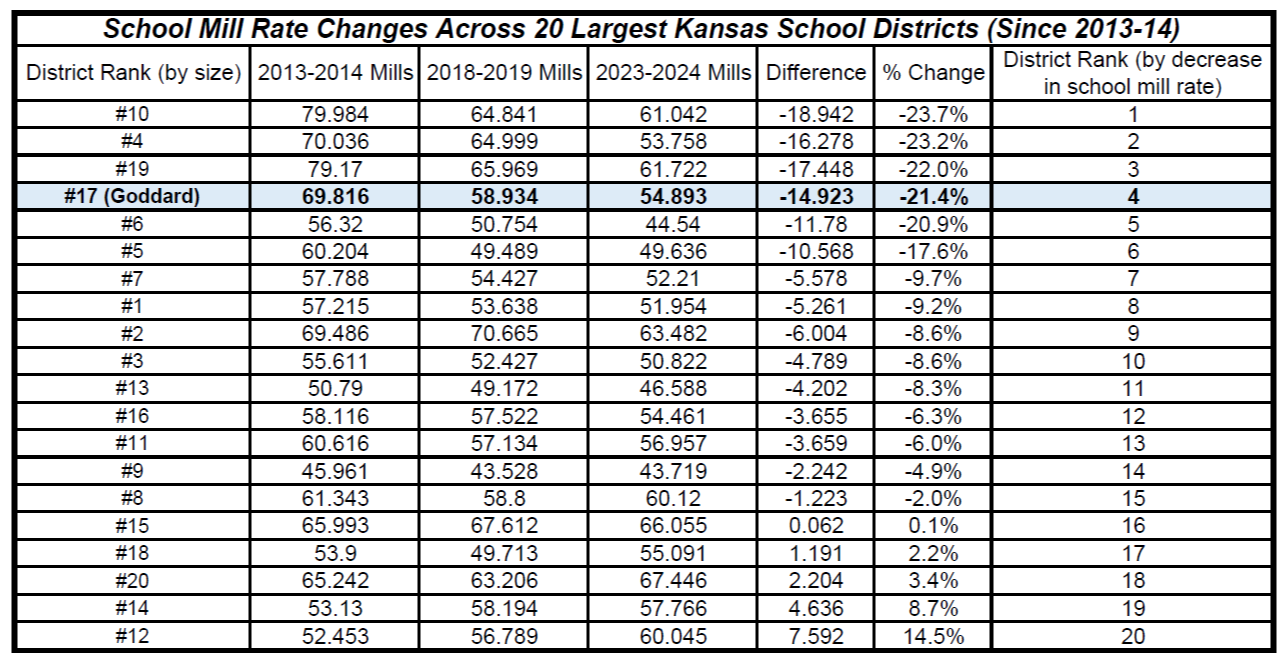

USD 265 is in a uniquely beneficial space, relative to other suburban school districts in Kansas - especially in the Wichita area. Due to the good stewardship, fiscal responsibility, and future-focused prioritization of USD 265 funds, the mill levy in Goddard has increasingly dropped over the last decade. If this bond does pass, USD 265 will still have a lower mill levy than a decade ago. This community has always invested in the future, and in our students. Now is the time to continue that legacy.

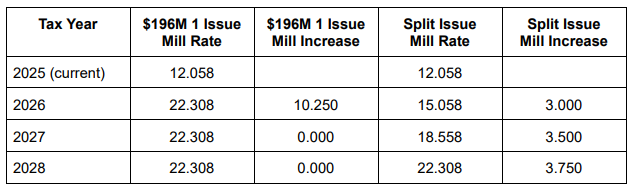

If the bond election passes, the estimated mill levy increase is 10.25 and that is based on a number of assumptions, mainly that all the bonds would be issued at the same time. It's more likely that the district would issue $100 million (M) soon after the election, then the other $96M two years later. Splitting up the issuance changes the timing of the mill rate increase, spreading out the increase as opposed to a sudden jump. Tax rates can vary based on residential, commercial, and agricultural land.

To see how this impacts your household, utilize the calculator here and be sure to input your family's appraised home value (NOT the market value). You can type in the appraised value of your home or duplex and it will calculate the monthly increase to your property taxes if the election passes. Please note: this calculator only works on homes or duplexes - other types of property, like commercial buildings or farm real estate, are assessed at different rates.

"An investment in knowledge pays the best interest." - Benjamin Franklin

Main Points

The district believes that a property owner in USD 265 will pay no more than 10.25 mills more than their current USD 265 bond interest mill levy. Historically, the mill levy rate increase has been vastly lower (i.e. - In the 2017 bond election, the district estimated the mill rate would increase by no more than 1.90 mills. The actual increase was 0.445 mills in the 2019 tax year. The current mill rate is 6.471 mills less than it was in 2017-18.)

This bond resolution will only cost homeowners in the district $9.82 per month (per $100,000 assessed home value) to generate $196M in projects that will positively impact students and staff districtwide.

Estimated Mill Levy Increase for a Proposed $196M Bond Issue

One of the first questions district patrons have after they hear of the proposed $196M bond question that will go before voters on Tuesday, May 13th, 2025 is ‘how much will this raise my taxes.’ This can be a difficult question.

First off - there are many factors that determine what a property owner's taxes will be. School district taxes are only a part of this, and the taxes that are dedicated to paying off bond debt are a portion of those. A property tax bill can also include city taxes, township taxes, county taxes, rural watershed districts and cemetery districts. There can also be taxes related to recreation commissions, community libraries and historical societies. The changes in the appraised value of the property from year to year are also a big factor.

Regarding school districts and their mill rates, there are several assumptions that must be made to estimate the possible increase to property taxes related to a bond election. The original assumptions that were made regarding the proposed bond election included:

Entire $196M of debt is issued at one time

Annual growth rate of property assessed valuations of 3% for the first 10 years, then 2.5% growth rate for the remaining 15 years

Interest rate on tax-free municipal bonds of 4.50%

State aid contribution of 12% towards the annual debt service

Using these assumptions the district’s bond advisors have estimated an increase of 10.25 mills.

Issue the $196M at Once Vs. Splitting the Issue

If the community votes in favor of the bond, this authorizes the district to issue General Obligation (GO) bonds to the public. The proceeds from those bonds provide the funds the district uses for the various construction projects described in the bond question. It further authorizes the district to raise the needed taxes to repay the GO bonds. Those bonds are set up with semi-annual payments to be paid off over a 25-year period.

The 10.25 mill levy increase is based on the assumption that all bonds would be issued at the same time. From the date of the election result, if the bond is approved, it typically takes between 60 and 90 days to issue the debt. In this case the assumption would be that the entire $196M of bonds would be issued as soon as possible after the vote.

It is unlikely the district would actually issue all of the debt at once. The proposed projects will take three or more years to complete, so it may make more sense to issue part of the bonds right away, and issue the rest later (a ‘split issue’). One scenario would be to issue $100M soon after the election, then wait another 18-24 months to issue the remaining $96M of bonds.

Splitting up the issuance means delaying the repayment on almost half of the bonds for up to 24 months. The first year lists the current mill levy rate for bond repayment. The $196M columns assume all debt is issued at one time, the ‘Split Issue’ columns are based on issuing $100M right away, then $96M two years later.

This changes the timing of the mill rate increase as follows:

By the third year, all bonds have been issued the mill rate is the same in both examples. But by splitting the bond issue the initial increase is spread out over the three-year period instead of happening all at once, with the first year increase only being 3.000 mills rather than the full 10.25 mills.

Assessed Valuation of Property Increases by 3% Annually

Another big driver of estimating a mill levy increase is estimating how much property values will increase over the life of the bond issue. As mentioned earlier these bonds will have a 25-year term. It makes sense to be conservative in estimating appraised value growth over a long term as the economy could go through several cycles of faster or slower growth.

In looking at the actual growth of the district recently, we see that the assessed property value in total has grown:

9.74% in 2024,

9.28% on average from 2020 through 2024,

6.83% on average from 2015 through 2024, and

5.58% on average from 2005 through 2024.

If the district used 5% as the estimated growth rate for the first 10 years instead of 3%, the average mill rate increase if $196M were issued all at once would lower that mill rate from 10.25 to 8.00 mills, a reduction of 2.25 mills or 22%. The higher growth rate would have a similar effect on a split issue.

Interest Rate of 4.50%

School districts typically issue GO bonds that are classified as ‘tax-free.’ This means that the investor does not pay income tax on the interest earnings of the municipal bond they are holding. This is a good deal for the investor, and also lowers the rate of interest the school district pays.

The district’s bond advisors again try to be conservative when estimating the interest rate for bonds that may not be issued for several months. It is likely, though not guaranteed, that the bonds will have a lower rate of interest than the current estimate. This would lower the annual repayment, so fewer tax dollars would be needed to repay the bonds. This, in turn, will lower the actual mill levy needed.

For example, if the interest rate is actually 4.25%, this will save about $490,000 in the first year of debt service (for $196M issued at one time), which would lower the mill rate between 0.6 and 0.8 mills, to between 9.45 and 9.65 mills instead of the currently estimated 10.25 mills.

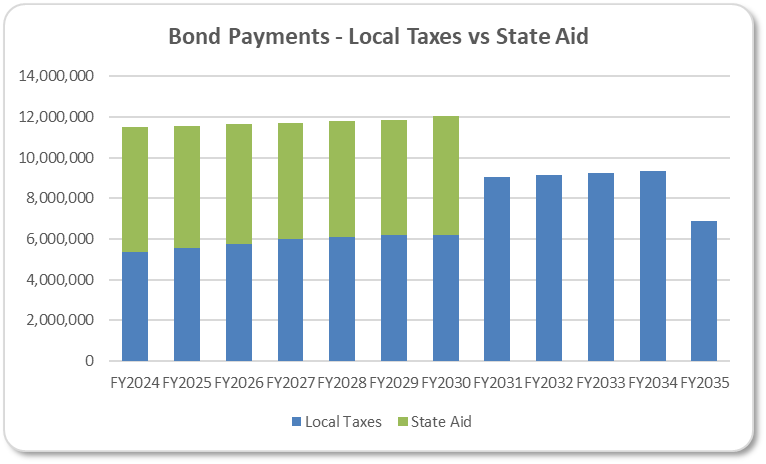

State Aid Contribution of 12%

The State of Kansas provides what is called ‘equalization state aid’ in a variety of funds for school districts. Equalization aid is meant to lower the property tax rates for most school districts across the state as compared to the highest property value per pupil districts in the state. Prior to equalization aid, USD 265 had mill rates as high as 100 mills. Now that equalization aid is more fully funded the district’s total mill rate is just under 55 mills.

For the 2024-2025 school year the district receives state equalization aid in the following percentages by fund:

Supplemental general fund = 59.63% state aid

Capital outlay fund = 62.00% state aid

Bond repayment - bonds issued before 2015 = 62.00%

Bond repayment - bonds issued between 2015 and 2022 = 6.00%

Bond repayment - bonds issued after 2022 = 12%

These vary greatly, and can change from year to year based on changes to the public school funding formula by the legislature, as well as enrollment growth of the district.

The equalization formulas are based on the assessed valuation of the USD 265 school district, divided by the number of enrolled students, and comparing that per pupil figure to all other districts across the state. As the Goddard school district does not have a large amount of industrial or retail commercial properties, while being the 17th largest district in the state, our district receives a large amount of equalization aid.

Part of the reason the mill rate increase is 10.25 the lower rate of equalization state aid being provided. If the state were to revert to the previous formula and the district received 62% state aid the estimated new mill rate would be much lower. With the substantial enrollment growth being projected there is a good chance the state aid rate will increase simply due to the assessed valuation being divided by a larger number of students.